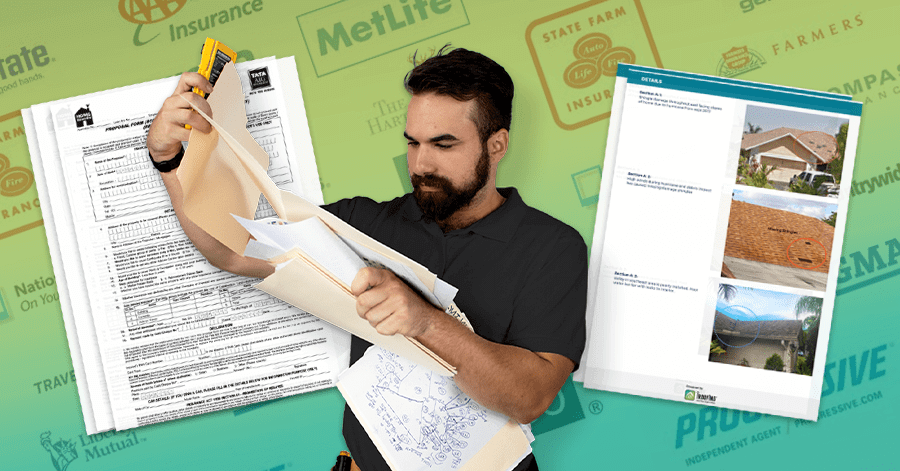

A Step-by-Step Guide to Success: Win A New Roof Paid For By Your Inurance Company

By: Kevin Stone

Category: Insurance Claim, Roofing

I. Understandiing Roof Damage Claims

Roof damage can be a stressful and challenging experience, and filing a claim with your insurance company can seem like a daunting task. However, knowing how to maximize your roof damage claim can make a big difference in the compensation you receive. This article provides a comprehensive guide on how to file a roof damage claim and highlights the benefits of working with an insurance claims specialist.

II. The Roadmap to a Successful Roof Damage Claim

A. Inspecting Your Roof

The first step in filing a roof damage claim is to thoroughly inspect your roof for signs of damage such as missing or damaged shingles, cracked tiles, dented metal, and other signs of wear and tear. Document the damage by taking photos and making a list of relevant details such as the type of roofing material, age of the roof, and location of damage. This step can increase the perplexity of your claim by providing specific information that your insurance company needs to process your claim.

B. Contacting Your Insurance Company

Once you have inspected your roof and gathered the necessary information, promptly contact your insurance company. Explain the situation and provide the information you have gathered, including photographs of the damage. Your insurance company will then assign an adjuster to investigate the claim and determine the amount of coverage you are entitled to. This step can increase the burstiness of your claim by including brief and direct sentences that convey the main message.

C. Submitting Essential Documentation

D. Working with the Adjuster

The insurance adjuster will require supporting documentation for your claim, such as receipts for repairs or a contractor’s estimate for repair costs. Keep all documents related to the claim in one place for easy access. The insurance adjuster will schedule a time to inspect your roof and assess the damage. Be present during the inspection to answer any questions and provide relevant information. The adjuster will provide a report on the extent of the damage and the cost of repairs. If you disagree with the report, you can negotiate or file a dispute, increasing the perplexity and burstiness of your claim.

E. Making Repairs

Once you have received the coverage you are entitled to, it is time to make necessary repairs. Choose to make repairs yourself or hire a professional contractor. Keep all receipts and documentation related to repairs in case you need to provide them to your insurance company later. After the repairs have been made, follow up with your insurance company to ensure the claim has been closed and you have received all coverage you are entitled to. Keep all documentation related to the claim, including the adjuster’s report, receipts for repairs, and any other relevant information. This step can increase the burstiness of your claim by including shorter and direct sentences.

F. Following Up with Your Insurance Company

After the repairs have been made, follow up with your insurance company to ensure the claim has been closed and you have received all coverage you are entitled to. Keep all documentation related to the claim including the adjuster’s report, receipts for repairs, and any other relevant information.

III. The Advantages of Working with An Insurance Claims Specialist

Expertise and Experience: an insurance claims specialist has years of experience and expertise in handling insurance claims, ensuring your claim is in good hands.

Improved Negotiations: An insurance claims specialist has the negotiation skills and knowledge to get you the best possible outcome.

Access to Resources: An insurance claims specialist has access to resources such as industry experts, contractors, and lawyers to help you win your claim.

Time Savings: Filing a claim can be time-consuming, but an insurance claims specialist can take care of the process for you, freeing up your time.

Increased Chances of Success: With the expertise and resources an insurance claims specialist, your chances of winning your claim and getting the coverage you deserve are significantly improved.

IV. Frequently Asked Questions

Q: What is considered roof damage?

Roof damage includes any signs of wear and tear, such as missing or damaged shingles, cracked tiles, dented metal, and other signs of damage.

Q: What should I do if I suspect my roof has damage?

Inspect your roof thoroughly, document the damage, and promptly contact your insurance company. Or have a contractor who is experienced in identifying storm damaged property provide a free inspection.

Q: How long does it take to file a roof damage claim?

A: The time it takes to file a roof damage claim can vary, depending on the insurance company, the extent of the damage, and the complexity of the claim. However, on average, it takes about two weeks from the time you file the claim to the time the insurance adjuster inspects your roof.

Q: Who is responsible for the cost of the repairs?

A: Your insurance company is responsible for covering the cost of the repairs, up to the limit of your policy. If the damage is covered by your policy, you may be responsible for paying a deductible, which is the portion of the repair costs you are responsible for.

Q: What if I disagree with the insurance adjuster’s report?

A: If you disagree with the insurance adjuster’s report, you can negotiate with the adjuster or file a dispute. An insurance claims specialist can help you negotiate with the adjuster and ensure that you get the coverage you deserve.

Q: What if my insurance company denies my claim?

A: If your insurance company denies your claim, you have the right to appeal the decision. An insurance claims specialist can help you appeal the decision and get the coverage you deserve.

Q: What if I need to make repairs before the insurance adjuster arrives?

A: If you need to make repairs before the insurance adjuster arrives, it’s important to keep receipts and documentation of the repairs. This information can be used to support your claim and ensure that you get the coverage you deserve.

V. Conclusion

Filing a roof damage claim can be a complex and overwhelming process, but with the right resources and support, you can ensure that you get the coverage you deserve. By following the steps outlined in this guide, and working with a professional claims network like Your Insurance Claims Network, you can get back to normal as soon as possible and restore your roof to its pre-damage condition. Don’t let a damaged roof stress you out – take the necessary steps to file a successful roof damage claim today.

About the Author:

Kevin Stone – Founder & CEO

Kevin Stone, the CEO of Your Insurance Claims Network (YICN) and YICN Roofing, is a master of construction with over three decades of experience! A true professional with a specialty in roofing, storm damage restoration, and insurance claims, Kevin has garnered a reputation as a construction industry expert. With years of sharpening his skills and knowledge, he is a go-to authority in the field, possessing an intricate comprehension of construction, particularly roofing and storm damage restoration.